The math involved in calculating how much you owe from each ‘chunk’ of income can get complicated. How do I calculate my taxes using these tax brackets? In this example, your marginal tax rate is 12%. We call the highest tax rate that you pay your marginal tax rate. In equation form, we’d write this out as: So you’ll pay two different tax rates: 10% on the first $10,275 ‘chunk’ of your income, and 12% on every dollar you made above $10,275. The $0 - $10,275 bracket, which taxes you at 10% That means you’ll fall into two different tax brackets and get taxed at two different rates: This means different parts of your income is taxed at a different rate.įor example, let’s say that your taxable income ends up being $20,000. Unless you made $10,275 or less in taxable income in 2022, it’s likely you fall into at least two brackets. Let’s take the IRS tax brackets for individual single filers in 2022: Tax rate (Keep in mind, these brackets are for income tax only capital gains tax uses its own set of brackets.) Once you’ve calculated your taxable income, it’s time to look at the IRS’s tax rate schedule-a fancy term for ‘big list of tax system brackets’-for the year you’re doing your taxes for. (Check out Bench’s Big List of Small Business Tax Deductions for more info.) Tax brackets are based on your taxable income, which is what you get when you take all of the money you’ve earned and subtract all of the tax deductions you’re eligible for. Married filing jointly or qualifying widow(er) It’s broken into the four most common filing statuses: individual single filers, married individuals filing jointly, heads of households, and married individuals filing separately: Tax rate These will be used for your 2023 tax filing. Here are the 2022 tax brackets according to the IRS.

Which tax bracket you fall into in the United States also depends on your filing status. Below are the latest State tax tables which are integrated into the United States Tax and Salary Calculators on iCalculator.What are the 2022 federal income tax brackets? State Tax Tables are updated annually by the each States Tax Administration Office. You can also find supporting links to the State Tax tables for each State linked from the Federal Tax Tables or select the current year State Tax Tables from the State list further down this page. Federal Tax Tablesīelow are the tax tables which are integrated into the United States Tax and Salary Calculators on iCalculator.

#Us federal tax brackets 2021 free

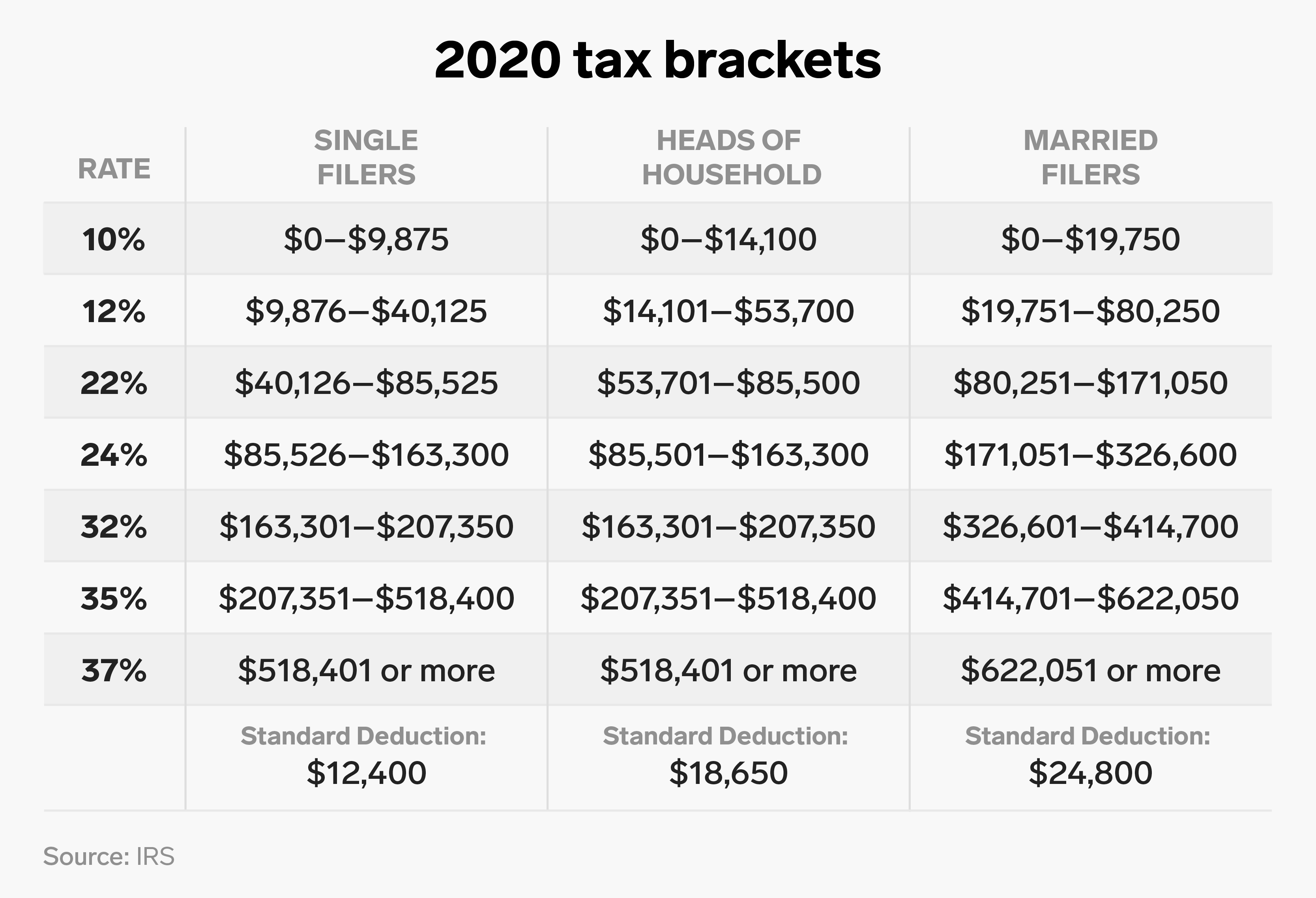

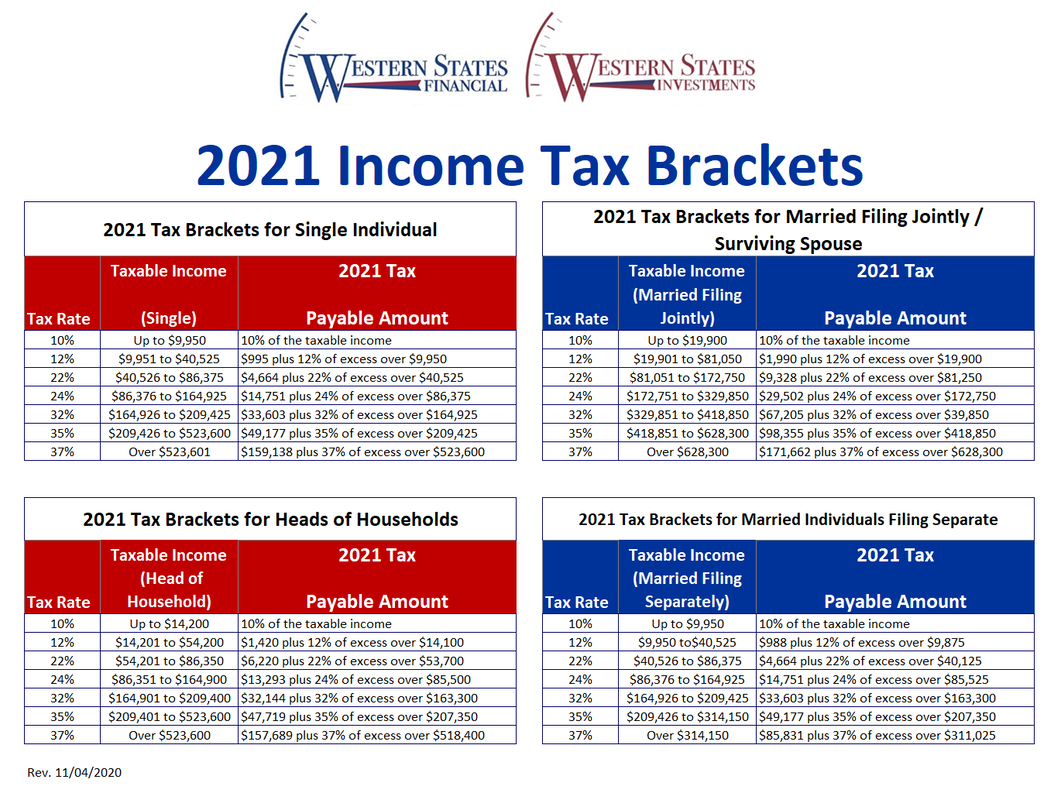

You may also be interested in using our free online 2021 Tax Calculator which automatically calculates your Federal and State Tax Return for 2021 using the 2021 Tax Tables (2021 Federal income tax rates and 2021 State tax tables). Then Taxable Rate within that threshold is:Ģ021 Federal Income Tax Rates: Married Individuals Filling Joint Returns If Taxable Income is:Ģ021 Federal Income Tax Rates: Married Individuals Filling Seperately If Taxable Income is:Ģ021 Federal Income Tax Rates: Head of Household If Taxable Income is:Ģ021 Federal Income Tax Rates: Widowers and Surviving Spouses If Taxable Income is: 2021 Federal Income Tax Rates: Single Individuals If Taxable Income is:

The Income Tax Rates and Thresholds used depends on the filing status used when completing an annual tax return. You will also find supporting links to Federal and State tax calculators and additional useful information to assist with calculating your tax return in 2021 2021 Federal Income Tax Rates and Thresholdsįederal Income Tax Rates and Thresholds are used to calculate the amount of Federal Income Tax due each year based on annual income. This page provides detail of the Federal Tax Tables for 2021, has links to historic Federal Tax Tables which are used within the 2021 Federal Tax Calculator and has supporting links to each set of state tax tables for 2021. The Internal Revenue Service (IRS) is responsible for publishing the latest Tax Tables each year, rates are typically published in 4 th quarter of the year proceeding the new tax year.

0 kommentar(er)

0 kommentar(er)